Just with a quick look at the stock market in 2016 and one is bound to flinch. As much as investors would not want to hear this fact, it is a reality that stock exchanges across the world are facing one of the worst starts in many years.

The DOW, an index of 30 largest companies in America has in the last month reports the ugliest kick over in its history. A quick shift to China’s stock exchange market and it is visible that the country’s slowing economy is taking a toll on the stock market. However, all is not lost.

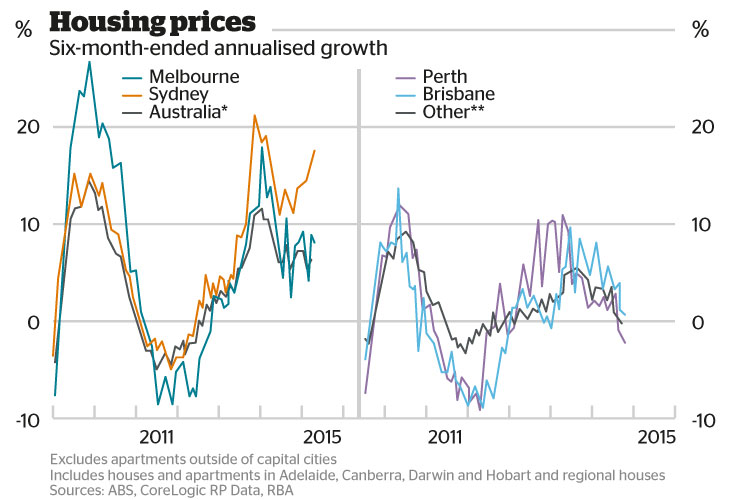

There are reasons for investors to smile, more especially, US investors. For starters, after many years of low growth, the US economy is not only in good shape but is also showing positive signs of growth, more especially in the real estate market. This is affirmed by the recent hike in Fed rates with further hikes anticipated in the near future.

As a matter of fact, in May 2015, the US economy surpassed expectations to hit an all-time high. Notwithstanding the recent oil prices crisis, the market has only slipped 10% below the all-time record level. The fact that the market is nowhere near the “bear market” (20% drop) is evidence that the stock market remains a lucrative investment option.

Other than the improving economy, history has proven that long-term investment in the stock pays off. As a matter of fact, tracing back stock exchange after World War II, evidence from S&P Capital IQ analyst shows that investors that retained their stocks for not less than 15 years, reaped immense profits. As much as things may look gloomy, they are not bound to remain the same forever.

Perhaps, the next question would be whether or not the stock market investments will hold in the face of increased animosity globally ranging from the Baltic Sea to the South China Sea. The truth is that such uncertainties are not good for any stock market, stock exchange or real estate investor. Indeed, the current levels of volatility will not do the world stock markets any good if they persist.

It can however not be ignored that recent trends have seen investors go against expectations and going ahead to invest irrespective of the ongoing events.

In stock market is often a good way to grow earnings in the long run. While investing does not necessarily translate into yearly profits, the up years no down surpass the down years.